The Police would like to alert the public to a few new variants of scam targeting bank customers. Since January 2019, the Police have received at least 60 reports of these new variants, with total losses amounting to at least $1.6 million.

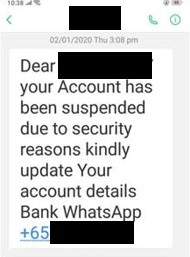

In the first variant, the scammers would call the victims via ‘Viber’, a mobile application, claiming to be a bank staff. The scammers alleged that the victims’ bank accounts had been locked or suspended, and offered to assist the victims to resolve the matter. In some cases, the scammers would direct victims to contact a specified number on WhatsApp for the purpose of verification.

In another variant of the scam, the victims would receive calls with an automated voice message purportedly from the bank, informing that their bank account had been locked or would be cancelled. Victims were then asked to press a number and the call would be transferred to someone claiming to be a staff from the bank.

In a third variant, the victims would receive an SMS message purportedly from the bank, informing them that their ATM card had been blocked or deactivated. The victims were directed to call a specified number to reactivate their ATM card.

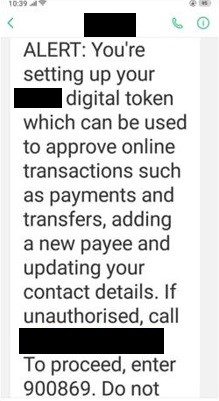

In all these cases, scammers would then ask for the victims’ personal particulars, internet banking details and One-Time Password (OTP). The victims subsequently discovered that unauthorised transactions were made from their bank accounts.

Members of the public are advised to adopt the following crime prevention measures:

- Beware of unsolicited messages or calls from persons impersonating as staff from banks. Scammers may use Caller ID spoofing technology to mask their actual phone number to display the bank’s number and logo as the profile picture on mobile applications such as ‘Viber’ and ‘WhatsApp’.

- Do not disclose your internet banking details such as account username or Personal Identification Number (PIN) to anyone through phone, email or SMS. Banks and government agencies will never ask you to disclose your internet banking details to them.

- Do not respond to digital token authentication requests via phone calls if you did not initiate any internet banking transaction. Do not authorise any suspicious authentication request.

- If you receive a suspicious call purportedly from your bank, hang up and call the hotline published on the bank’s website to verify the authenticity of the request. Do not call the number provided by the caller.

If you wish to provide any information related to such scams, please call the Police hotline at 1800-255-0000, or submit it online at www.police.gov.sg/iwitness. If you require urgent Police assistance, please dial ‘999’.

To seek scam-related advice, you may call the anti-scam helpline at 1800-722-6688 or go to www.scamalert.sg. Join the ‘Let’s Fight Scams’ campaign at www.scamalert.sg/fight by signing up as an advocate to receive up-to-date messages and share them with your family and friends. Together, we can help stop scams and prevent our loved ones from becoming the next victim of scam.

SINGAPORE POLICE FORCE

14 January 2020 @ 3:00 PM