The Anti-Scam Centre (ASC) of the Singapore Police Force, together with five banks, namely DBS, UOB, OCBC, HSBC, and Standard Chartered Bank, conducted a four-day joint enforcement operation from 22 to 25 March 2022. During the operations, officers and our partners successfully intervened in more than 150 cases of investment and job scams.

Interventions in Investment and Job Scams

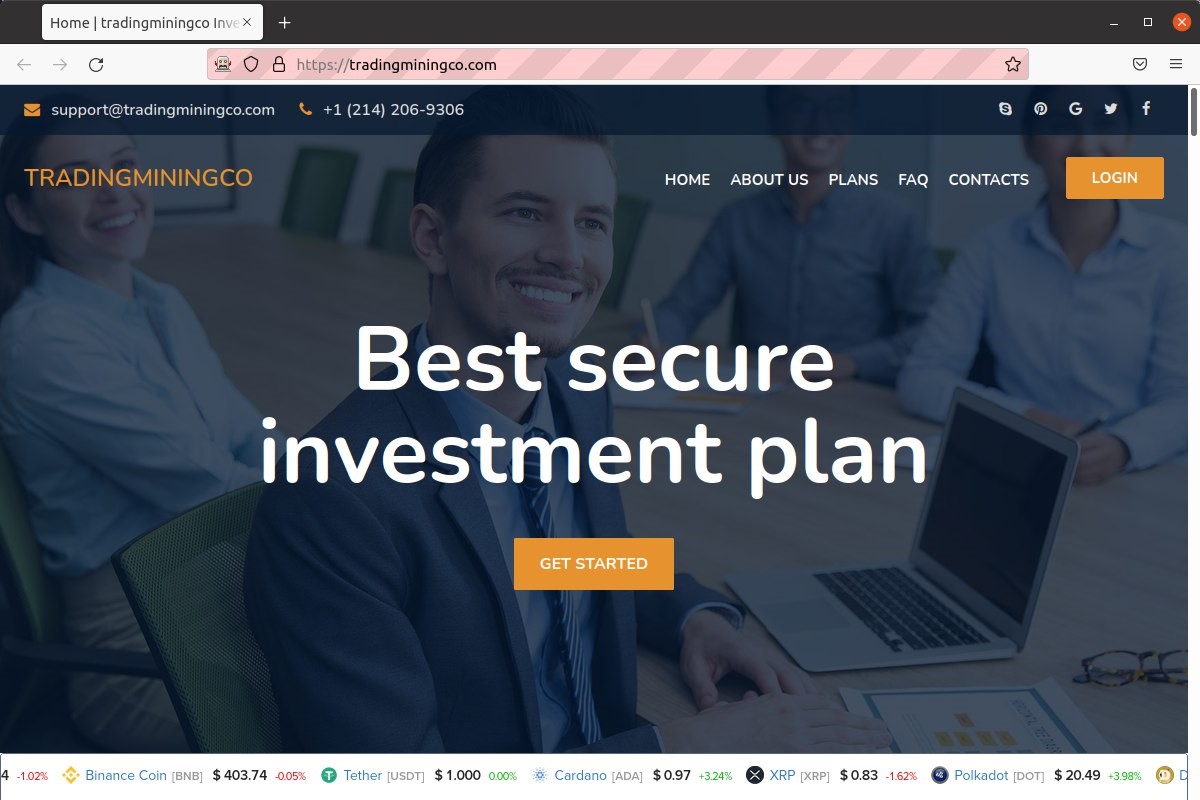

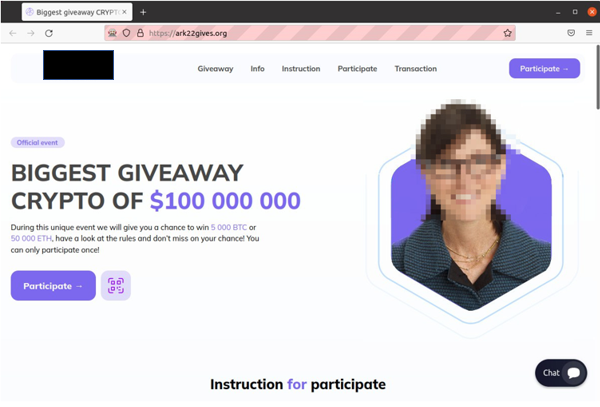

In investment scams, the scammers would claim to be financial professionals and cultivate victims via social media platforms. Once lured, the victims would be introduced to investment experts who claim to be sharing sure-win tips. Victims would be enticed by the promise of easy earnings and transfer their money to banks accounts. In many instances, victims would earn a small profit from the ‘investment’ at the initial stage, leading them to believe that the scheme was legitimate and lucrative. Thereafter, victims might be asked to pay administrative fees, legal fees or taxes in order to encash their profits. After additional sums of monies were deposited into the designated bank accounts, the scammers would become uncontactable.

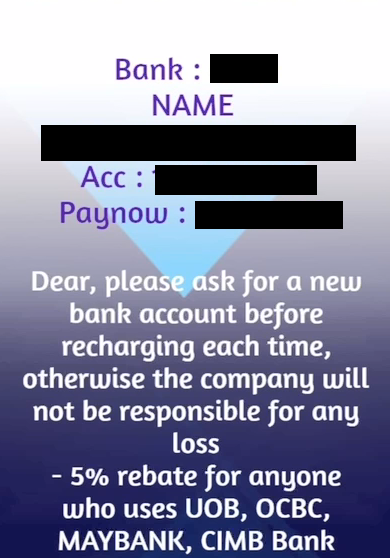

For job scams, victims would typically respond to job advertisements for quick cash on social media platforms and chat applications. They would then be told to order items from online platforms, purportedly to boost sales figures, progressing from lower-cost items to more expensive items. Victims would pay for the items by funds transfers to bank accounts and would initially be reimbursed the full amount together with an attractive commission. When the scheme progresses to a point where victims have transferred large sums of money for their orders, the scammers would become uncontactable, and victims would be left empty-handed.

During the enforcement operation, officers from the ASC, the seven Police Land Divisions and the five banks conducted live interventions by analysing the fund flow of bank accounts, which were surfaced in scam reports. They then worked together to engage unsuspecting victims who had been transferring monies to scam-tainted bank accounts. The victims were informed that that they could have fallen prey to scams and were advised to stop any further monetary transfers. Many of them were completely unaware that they had been scammed prior to Police engaging them.

Enforcement Operations

Officers from the Commercial Affairs Department and the seven Police Land Divisions also mounted island-wide raids and arrested 29 men and 6 women aged between 16 and 66. A total of 255 individuals are currently assisting with investigations for their suspected involvement in more than 1,200 cases involving more than $31 million.

Some of these individuals were alleged to have sold their Singpass details to scammers, giving the scammers unauthorised access to digital services under the individuals’ names. This allowed the scammers to carry out acts such as registering businesses and opening bank or crypto-exchange accounts, for the purpose of receiving illegal proceeds from scam victims. In some instances, the Singpass details were also misused by scammers to subscribe to new mobile lines to communicate with victims. Investigations are ongoing into various offences, including cheating, money laundering, facilitating unauthorised access to computer material, and carrying on the business of a payment service without licence.

The offence of facilitating unauthorised access to computer material under Section 3 read with Section 12 of the Computer Misuse Act 1993 (CMA) carries an imprisonment term of up to two years, or fine, or both. The offence of unauthorised disclosure of access code for any wrongful gain or unlawful purpose under Section 8 of the CMA carries an imprisonment term of up to three years, or fine, or both. The offence of cheating under Section 417 of the Penal Code 1871 is punishable with imprisonment of up to three years and fine. The offence of carrying on an unlicensed business of providing payment service under Section 5 of the Payment Services Act 2019 carries a fine not exceeding $125,000, imprisonment for a term not exceeding three years, or both. The offence of money laundering under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992 carries an imprisonment term of up to 10 years and a fine of up to $500,000.

Members of the public are advised to remain vigilant and adopt the following crime prevention measures:

- Be wary when receiving unsolicited offers of investment or job opportunities via social media platforms or chat applications.

- Understand that investments with high returns will come with high risks.

- Always check with a licensed financial advisor before making any investment.

- Do not be enticed by ‘jobs’ that promise the convenience of working from home and unusually high salary for relatively easy responsibilities. No legitimate business will require employees to utilise their own bank accounts to receive monies on the business’ behalf.

- Never disclose your Singpass ID, password or Two-Factor Authentication (2FA) details to others.

- Report any suspicious activities on your Singpass account to the Singpass helpdesk at 6335 3533 immediately. You may also reset your Singpass password at www.go.gov.sg/reset-sp-pw.

To avoid becoming involved in money laundering activities, members of the public should always reject requests to use their personal bank accounts to be used to receive and transfer money for others. The Police also would like to caution members of the public against relinquishing their own Singpass accounts to others. Crime syndicates can make use of the disclosed Singpass login details to access a whole suite of digital services, including opening bank accounts, registering businesses in the owner’s name, making cash advance from the banks, and even accessing the owner’s CPF monies.

For more information on scams, members of the public can visit www.scamalert.sg or call the Anti-Scam Hotline at 1800-722-6688. Anyone with information on such scams may call the Police hotline at 1800-255-0000 or submit information online at www.police.gov.sg/iwitness. All information will be kept strictly confidential.

Examples of fake investment websites set up by scammers

Example of payment instructions sent by scammer during a job scam

Arrests made during island-wide raids

Officers from the ASC conducting live interventions during the enforcement operations by analysing the fund flow of bank accounts, which were surfaced in scam reports

SINGAPORE POLICE FORCE

27 March 2022 @ 12:00 PM