The Police would like to alert members of the public to a scam trend where scammers impersonate banks in SMSes sent to victims and offer fixed deposit scheme promotions with high interest rates. Since January 2024, at least 12 victims have fallen prey to this scam, with total losses amounting to at least $650,000.

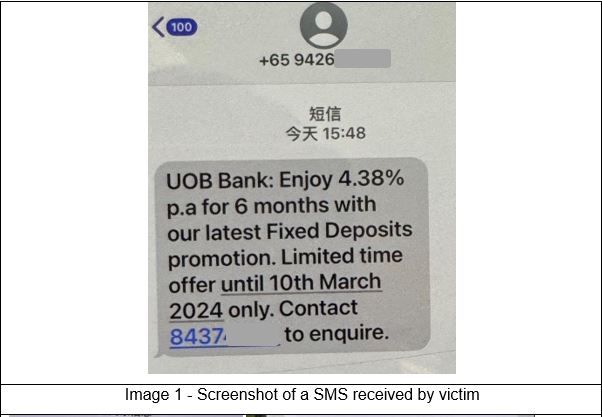

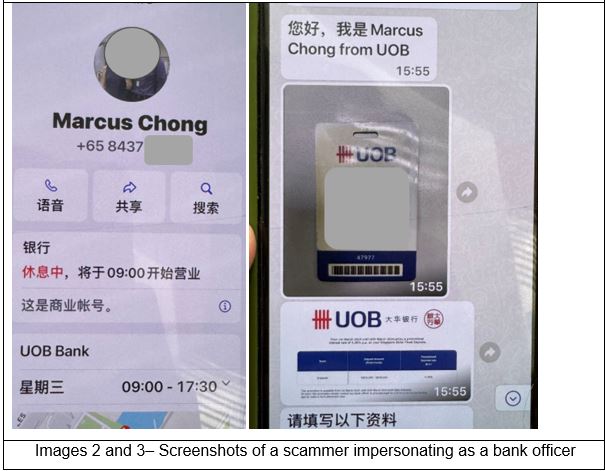

Victims would receive SMSes from unknown +65 local mobile numbers, purportedly from banks, promoting fixed deposit schemes with high interest rates. They would be instructed to contact a number provided within the SMS to indicate their interest and obtain more details of the promotion. Once contacted, scammers would pose as bank agents and provide fraudulent identification such as staff passes. They would then seek victims’ personal particulars to “apply for the fixed deposit promotion” and subsequently claim to have registered a bank account under the victims’ names. In some cases, victims would receive forged bank statements claiming that new bank accounts are under their names.

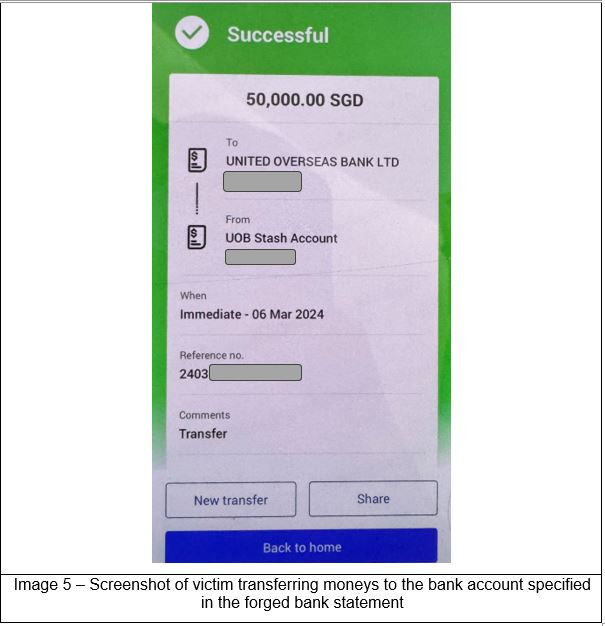

Victims would be instructed to deposit / transfer money into these bank accounts. Victims were told that the accounts are created “for them” or is an account to “hold the funds prior to the creation of their account”, thereby dissuading further verification.

Victims would realise that they had been scammed when they log into their banking application and find no changes to system records. In some instances, the scammer would quote an “activation period” which delays the discovery of the scheme. When victims eventually check directly with the banks on the accounts that they transferred money to for the scheme, they were informed that those accounts belonged to other persons and were not fixed deposit accounts created for the victims.

The Police would like to advise members of the public to adopt the following precautionary measures:

- ADD – Add the ScamShield App to protect yourself from scam calls and SMSes. Set security features (e.g. set up transaction limits for internet banking transactions, enable Two-Factor Authentication (2FA), Multifactor Authentication for banks and e-wallets).

- CHECK – Check for scam signs and with official sources (e.g., visit www.scamalert.sg or call the Anti-Scam Helpline at 1800-722-6688). Check with the banks at their official contact centres on how fixed deposits can be placed

- TELL – Tell the Authorities, family, and friends about scams. Report any fraudulent transactions to the bank immediately.

If you have any information relating to such crimes or if you are in doubt, please call the Police Hotline at 1800-255-0000, or submit it online at www.police.gov.sg/iwitness. All information will be kept strictly confidential. If you require urgent Police assistance, please dial ‘999’.

For more information on scams, members of the public can visit www.scamalert.sg or call the Anti-Scam Helpline at 1800-722-6688. Fighting scams is a community effort. Together, we can ACT Against Scams to safeguard our community!

Annex A

SINGAPORE POLICE FORCE

11 April 2024 @ 5:40 PM