The Singapore Police Force and Monetary Authority of Singapore (MAS) would like to alert members of the public to scams leveraging MAS’ Register of Representatives e-service platform to deceive victims into believing that they are MAS officials. The Register of Representatives is not a list of MAS employees. Since March 2025, there have been at least three cases reported, with total losses amounting to at least $614,000.

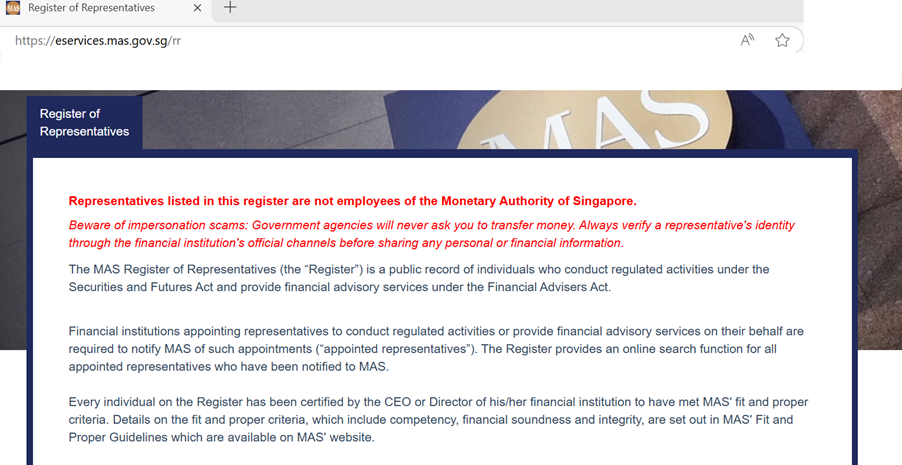

In this scam variant, victims would receive unsolicited calls from local numbers starting with “8xxx xxxx” or “9xxx xxxx”, from individuals posing as an MAS official. To enhance their credibility, scammers would ask victims to verify their identity and registration number by keying in their name in a legitimate MAS e-service portal “Register of Representatives” (https://eservices.mas.gov.sg/rr). This Register of Representatives is a public record of representatives appointed by financial institutions who conduct regulated activities under the Securities and Futures Act and provide financial advisory services under the Financial Advisers Act – it is not a list of MAS employees. In any case, the website alone cannot be used to verify whether the person on the phone is indeed the listed individuals.

Thereafter, the scammer would inform victims that their bank accounts had been used in money laundering activities or that their personal information had been compromised. Victims would be tricked into believing that they are under investigation and to disclose their personal information – including bank account details, personal particulars, SingPass password or one-time passwords – or to transfer money to a bank account to assist in investigations. In some cases, the designated bank account would reflect a PayNow Payee display name that mirrors the victim’s name, further convincing victims that the account is legitimate. Victims would comply and only realise that they had been scammed when the scammers became uncontactable.

Singapore Government officials, including MAS, will never ask members of the public to do the following over the phone:

- Ask you to transfer money;

- Ask you to disclose banking details;

- Ask you to install mobile apps from unofficial app stores

- Transfer your call directly to Police, except when you call 995 for life threatening emergencies

Members of the public should not transfer money or disclose your personal details to unknown persons. Do not trust someone just because he/she has your personal information (e.g. name or NRIC). Note that PayNow account names can be changed easily, so do not believe scammers when they claim that a PayNow account has been opened in your name. Members of the public are encouraged to adopt the following precautionary measures:

- ADD – Add the ScamShield App to block calls and filter SMSes. Set transaction limits that are adequate for daily expenses, and lower transaction notification thresholds. Alert the bank immediately of any suspicious activity in your bank account. Activate the Money Lock feature of your bank to “lock up” a portion of your money so that it cannot be transferred out digitally by anyone. Change any passwords you have that contain your NRIC immediately.

- CHECK – Do not use the website or telephone number that the scammer gives you. If in doubt, check for scam signs with official sources such as the ScamShield App. Call and check with the 24/7 ScamShield Helpline at 1799. Government SMSes will only be sent from the gov.sg SMS Sender ID.

- TELL – Tell the authorities, family, and friends if or when you encounter scams. If you suspect that you have fallen victim to a scam, call your bank immediately to block any fraudulent transactions and make a police report.

For more information on scams, members of the public can visit www.scamshield.gov.sg. Fighting scams is a community effort. Together, we can ACT Against Scams to safeguard our community!

Screenshot of MAS’ Register of Representatives e-platform

MONETARY AUTHORITY OF SINGAPORE

02 April 2025 @ 6:45 PM