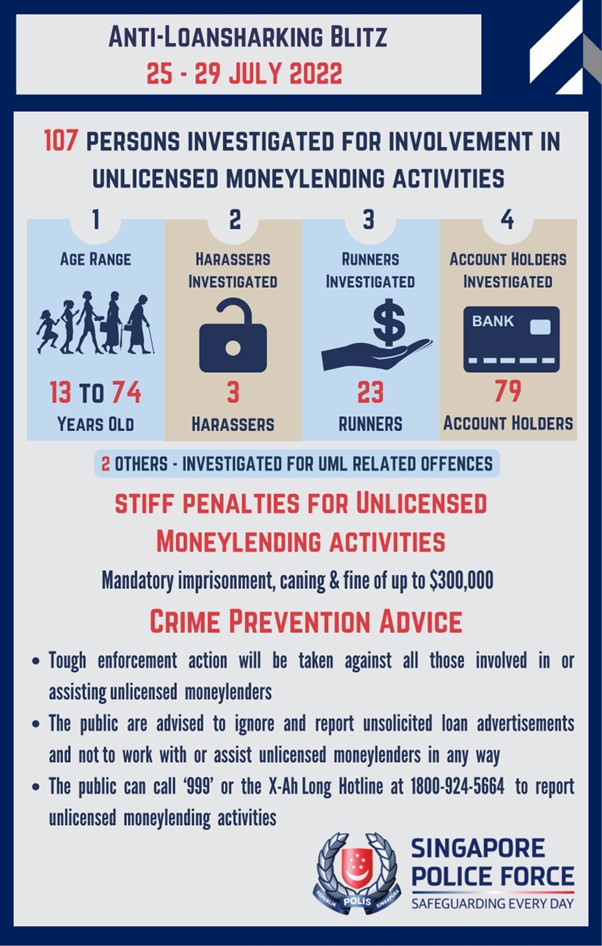

The Police are investigating 107 persons, aged between 13 and 74, for their suspected involvement in unlicensed moneylending activities.

During a five-day anti-unlicensed moneylending operation conducted between 25 and 29 July 2022, officers from the Criminal Investigation Department and the seven Police land divisions conducted simultaneous raids island-wide.

Preliminary investigations revealed that three persons had allegedly conducted harassment at debtors’ residences, while 23 persons are believed to be runners who had either assisted in unlicensed moneylending businesses by carrying out Automated Teller Machine (ATM) transfers or taking photographs of debtors’ residences. One person had assisted the unlicensed moneylenders in their businesses by subscribing to mobile lines, and one person had provided false contact information to an unlicensed moneylender, which led to harassment being carried out against an innocent victim’s residence.

The remaining 79 persons are believed to have opened bank accounts and provided their ATM cards, Personal Identification Numbers (PINs) and/or Internet Banking tokens to unlicensed moneylenders to facilitate their unlicensed moneylending.

Investigations against all the persons are ongoing.

Under the Moneylenders Act 2008:

- The offence of carrying on or assisting in a business of unlicensed moneylending carries an imprisonment term of up to four years, a fine between $30,000 and $300,000, and caning of up to six strokes.

- The offence of acting on behalf of an unlicensed moneylender, committing or attempting to commit any acts of harassment carries an imprisonment term of up to five years, a fine between $5,000 and $50,000, and caning between three and six strokes.

- The offence of providing false contact information to obtain loans from unlicensed moneylenders carries an imprisonment for a term of up to 12 months.

The Police will continue to take tough enforcement action against those involved in the unlicensed moneylending business, regardless of their roles, and ensure that they face the full brunt of the law. This includes taking action against those who open or give away their bank accounts to aid unlicensed moneylenders.

Unlicensed moneylenders are increasingly using text messaging or online platforms to send unsolicited loan advertisements. Members of the public are reminded not to reply or respond to such advertisements and to report these messages as spam. Members of the public are also advised to stay away from unlicensed moneylenders and not to work with or assist them in any way. The public can call the Police at ‘999’ or the X-Ah Long hotline at 1800-924-5664 if they suspect or know of anyone who could be involved in unlicensed moneylending activities.

SINGAPORE POLICE FORCE

02 August 2022 @ 5:55 PM