On 15 August 2025, Huang Yiwen (“Huang”), the director of a registered commercial market maker company, was sentenced to 15 months and 54 weeks’ imprisonment after he pleaded guilty to 24 counts of false trading offences under Section 197 of the Securities and Futures Act (SFA) read with Section 109 of the Penal Code (PC). Another 88 charges for similar offences were taken into consideration for the purposes of sentencing.

Huang was first charged in court on 20 September 2023 and further charges were tendered against him on 12 December 2023. Broadly, Huang faced two sets of charges.

The first set of charges (price rigging charges) were for conspiring with then-executives of three companies listed on the Singapore Exchange (SGX) to create a misleading appearance with respect to the price of each company’s securities between 2017 and 2019. The three companies are Mainboard-listed New Silkroutes Group Limited (New Silkroutes) and TEE International Limited (TEE International), and Catalist-listed AGV Group Limited (AGV). Huang’s company, GTC Group Pte Ltd (GTC), was registered as a commercial market maker with the SGX under the Market Maker and Liquidity Provider Incentive Scheme for cash equity securities. GTC was engaged by these three companies to provide market making services.

The second set of charges (active trading charges) were for conspiring with two other individuals to create a misleading appearance of active trading in the securities of four SGX-listed companies, namely TEE International, AGV, Mencast Holdings Ltd (Mencast Holdings) and BRC Asia Limited (BRC Asia), as well as the units of one SGX-listed real estate investment trust (REIT), Sasseur REIT, between 2017 and 2020.

Price rigging - New Silkroutes securities

Huang admitted to conspiring with New Silkroutes’ former Chief Executive Officer (CEO), Goh Jin Hian (“Goh”), former Chief Operating Officer (COO), Oo Cheong Kwan Kelvyn (“Oo”), and former Finance Director, Teo Thiam Chuan William (“Teo”), to create a misleading appearance with respect to the price of the company’s securities on 31 days between 26 February 2018 and 27 August 2018.

Sometime in February 2018, GTC was engaged by New Silkroutes to provide market making services for the company’s securities. During the engagement, Huang discovered that the true purpose of GTC’s engagement was to purchase New Silkroutes securities in order to push up its price. Huang also learnt that part of the reason for seeking to push up or support the price was that NSG wanted the share prices to be at certain levels for corporate acquisitions or funding, or to create a favourable perception of NSG’s securities following announcements.

Over these 31 days, a total of 10,955,300 securities were traded pursuant to the conspiracy, which constituted 41.53% of the total market volume and caused New Silkroutes’ securities to close higher by up to 7.55%.

Teo has pleaded guilty, while the case against Goh and Oo remains ongoing.

Price Rigging - TEE International securities

Huang admitted to conspiring with TEE International’s former Group CEO, Phua Chian Kin (“Phua”), and Phua’s special assistant, Neo Weng Meng, Edwin (“Neo”) to create a misleading appearance with respect to the price of the company’s securities on 50 days between 1 March 2018 and 30 April 2019.

GTC was engaged by TEE International to provide market making services for the company’s securities on 8 January 2018. In the course of the engagement, Huang became aware that Phua wanted to push up or maintain TEE’s share prices, which Huang eventually knew was to avoid margin calls in Phua’s trading accounts and loan account.

Over these 50 days, a total of 98,361,800 securities were traded pursuant to the conspiracy constituted 88.09% of the total market volume during the same period and caused TEE International’s securities to close higher by up to 9.71%.

Neo has pleaded guilty, while the case against Phua remains ongoing.

Price Rigging - AGV securities

Huang admitted to conspiring with AGV’s founder and former CEO Ang Nam Wah Albert (“Ang”) as well as, Sim Teck Chye (“Sim”), who was then employed as an Investor Relations Executive, to create a misleading appearance with respect to the price of AGV securities on 12 days between 23 November 2017 and 30 January 2018.

GTC was engaged by AGV to provide market making services for the company’s securities on 5 October 2017. In the course of the engagement, Huang was eventually instructed to help maintain AGV’s share price and to push it up where possible. One reason for doing so was to aid AGV in share placement negotiations with other parties.

As a result of the trades executed pursuant to the conspiracy on these 12 days, AGV securities closed higher by up to 4.27%.

Both Ang and Sim have pleaded guilty.

Active trading charges

Finally, Huang also admitted to conspiring with two individuals, Tay Sze Chien (“Tay”) and Tan Wei Liang (“Tan”), to create misleading appearances of active trading in five SGX listed counters from September 2017 to February 2020. At the material time, Tay was a fund manager while Tan was a licensed trading representative.

Between September 2017 and September 2018, GTC was engaged by five listed companies / REIT, namely TEE International, AGV, Mencast Holdings, BRC Asia, and Sasseur REIT, to provide market making services.

Sometime in 2017, Huang enlisted Tay’s help to increase the traded volume of the five counters, as the liquidity of the counters was poor. This was done through a “cross-trade” scheme where Tay would buy a parcel of securities/units from Huang on the market before selling these securities/units back to him at higher prices. This would enable Tay to earn a profit from such trades. Eventually, Tan also joined the scheme.

This scheme served two main purposes. First, it aimed to increase the trading activity in these five counters which would favourably reflect GTC’s performance as a market maker. Second, the increased trading activities in these counters could attract more market participants to trade, increasing the likelihood that GTC could sell the securities/units it amassed at better prices.

The impact of the trades pursuant to the conspiracy was as follows:

- TEE International: 310.2 million securities traded over 153 days, which accounted for 69.6% of the total market traded volume over the same period

- AGV: 281.7 million securities traded over 104 days, which accounted for 73.6% of the total market traded volume over the same period

- Mencast Holdings: 489.5 million securities traded over 254 days, which accounted for 85.2% of the total market traded volume over the same period

- BRC Asia: 171.7 million securities traded over 365 days, which accounted for 70.0% of the total market traded volume over the same period

- Sasseur REIT: 35.1 million securities traded over 51 days, which accounted for 58.2% of the total market traded volume over the same period

The false trading only ceased when the CAD commenced investigations. Both Tay and Tan have pleaded guilty.

CONCLUSION

On 15 August 2025, Huang was sentenced to an aggregate sentence of 15 months and 54 weeks’ imprisonment. In passing the jail term, the court noted that “market rigging adversely affects the integrity of the financial market by causing the information conveyed on the market to be distorted and such offences will ordinarily warrant a custodial sentence”. In Huang’s case, a stiff jail term was meted out after the court took into account, amongst other things, the fact that Huang had not only committed “a whole slew of market misconduct offences”, he had also done so in an abuse of his position as a registered market maker.

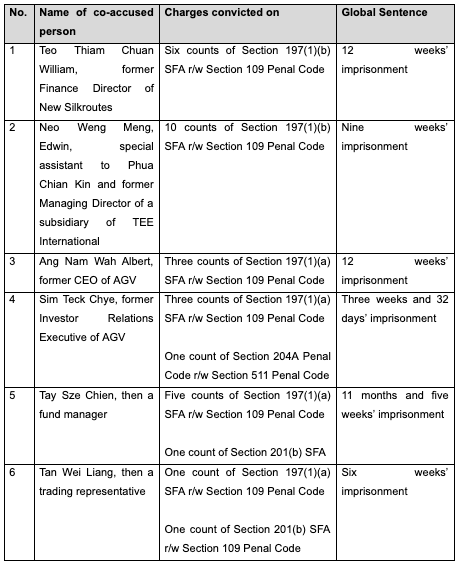

Details of the outcomes for the six co-accused persons who had pleaded guilty are given in Annex A.

Director of CAD, Mr David Chew, said, “Market makers play a crucial role in maintaining market liquidity. Market participants have a legitimate expectation that market makers discharge this role honestly. When a market maker purveys his services to listed companies to engage in market manipulation for mutual benefit, it undermines Singapore’s hard-earned reputation as a trusted and reliable place to trade securities. Such dishonest conduct strikes at the heart of Singapore’s capital markets – our integrity. CAD will rigorously pursue and bring such bad actors to justice, to ensure that our markets remain fair, orderly and transparent.”

The above convictions were the result of a joint investigation carried out by the CAD and the Monetary Authority of Singapore, following a referral from the Singapore Exchange Securities Trading Limited.

Annex A

SINGAPORE POLICE FORCE

18 August 2025 @ 10:40 AM