Between 1 January and 31 March 2020 , at least S$41.3 million dollars were lost to scam mers, based on cases that were reported to the Police. This is about S$9 million (or 27.9%) more compared with the same period last year. The majority of such cases were masterminded by overseas scammers.

The Police’s seven land divisions and Commercial Affairs Department have investigated 751 people based in Singapore for their suspected involvement in scam-related offences that took place in this period, with an involved amount of more than S$6.1 million.

In March alone, the number of scam cases totalled 692, and involved a total amount of at least $3.9 million. 202 men and 131 women, aged between 16 and 70, were investigated for their involvement in mainly e-commerce or loan scams. These suspects were largely fraudulent online sellers in e-commerce scams, or money mules who helped transfer money that were fraudulently obtained from scams.

The offence of cheating under section 420 of the Penal Code is punishable with an imprisonment term of up to 10 years and a fine. The offence of money laundering under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act is punishable with an imprisonment term of up to 10 years and/or a fine of up to S$500,000.

Top three scams committed from January to March 2020

E-commerce scams was the top scam type reported to the Police in the first three months of 2020. The second and third most reported scam types were ). Annex Asocial media impersonation scams and loan scams respectively (see

a) E-commerce scams

· The number of e-commerce scam cases increased by 116.2% to 1,159, from 536 in the same period last year.

· The total amount cheated was at least S$1.3 million, compared to S$469,000 in the same period last year. The largest sum cheated in a single case was S$175,000.

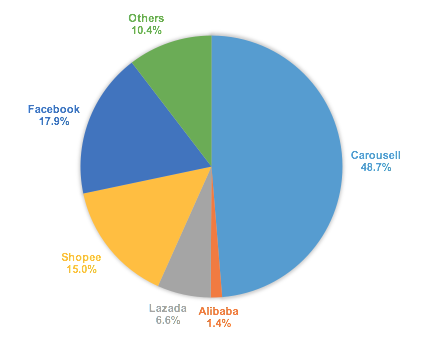

· ).Annex BCompared to the same period last year, the number of e-commerce scam cases on Carousell fell, but other digital platforms such as Facebook, Instagram, Shopee and Lazada saw increases in the number of such scams (see

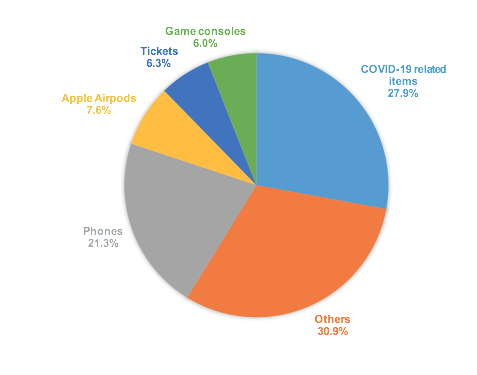

· ).Annex CThe merchandise involved in such scams included COVID-19 related products such as face masks, and electronic products such as game consoles and phones (see

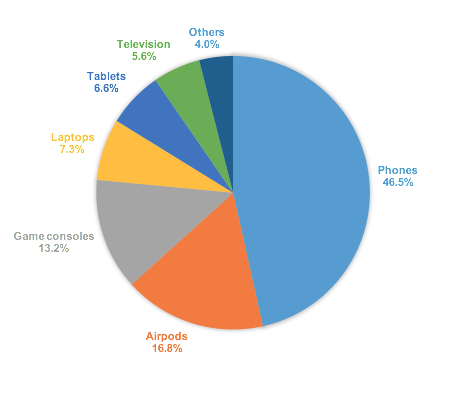

· ) online, particularly during the circuit breaker period, when more scammers may be taking advantage of the increased demand for such products.Annex DThe Police are particularly concerned about e-commerce scams involving electronic products. There were more than 530 reports of such scams, with total losses amounting to at least S$380,000. This represents a 129.9% increase in the number of reported cases, and a 43.9% increase in the total amount lost, compared to the same period in 2019. Organisations and individuals are advised to stay vigilant when making purchases for such products (see

b) Social media impersonation scams

· The number of social media impersonation scam cases jumped more than ten-fold to 466, from 33 in the same period last year.

· The total amount cheated was at least S$1 million, compared to S$256,000 in the same period last year. The largest sum cheated in a single case was S$302,000.

· In such cases, scammers would usually ask the victims for their personal details such as their mobile number, Internet banking account details and One-Time Password (OTP), on the pretext of helping them to sign up for fake contests or promotions allegedly organised by Lazada, Shopee and Qoo10. Victims would later discover that fraudulent transactions had been made from their bank accounts and mobile wallets without their consent. Individuals are advised to never share their Internet banking account details and OTPs with anybody – legitimate contests or promotions will never ask for such details.

c) Loan scams

· The number of loan scam cases increased by 49.8% to 421, from 281 in the same period last year.

· The total amount cheated was at least S$1.6 million, compared to S$863,000 in the same period last year. The largest sum cheated in a single case was S$92,000.

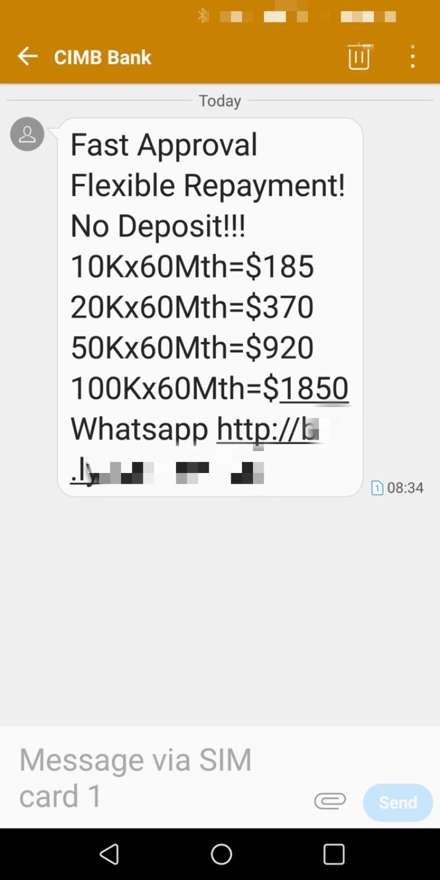

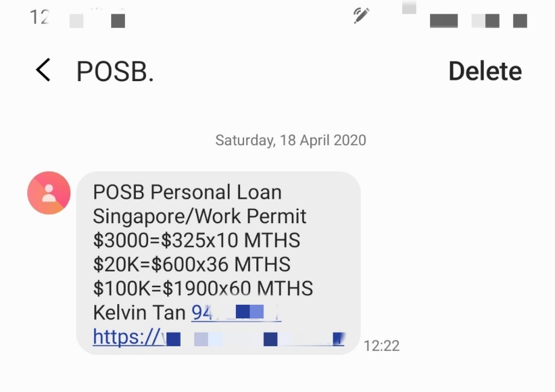

· for examples of such screenshots).Annex EThe Police would like to highlight the continued trend of loan scams targeting bank customers. Members of the public would receive spoofed loan advertisement messages purportedly sent by banks such as POSB, DBS, UOB, CIMB and OCBC. Banks and licensed moneylenders are not allowed to send out such loan advertisements (refer to

Other scams of concern committed from January to March 2020

The Police would like to highlight the following scam types which are also of concern:

a) Bank phishing scams

· The number of bank phishing scam cases increased sharply by more than ten times to 374, from 30 in the same period last year.

· The total amount cheated was at least S$1.6 million, compared to S$69,000 in the same period last year. The largest sum cheated in a single case was S$114,000.

· In some cases, scammers would call the victims through phone applications such as imo, WhatsApp and Viber, posing as bank staff, and ask for their Internet banking details such as account usernames, Personal Identification Numbers (PIN) or OTPs. The scammers would then transfer money out of the victims’ accounts. Some of the victims were also asked to provide their details on fraudulent websites, after clicking on phishing URLs in SMSes purportedly sent by the banks.

· Members of the public are advised not to reply or click on URL links in unsolicited SMSes or emails. They should beware of phishing websites that may look genuine, and never disclose Internet banking details to anyone.

b) Internet Love Scams

· The number of Internet love scam cases increased by 33.6% to 175, from 131 in the same period last year.

· The total amount cheated decreased to about S$6.6 million, from S$7.1 million in the same period last year. The largest sum cheated in a single case was S$450,000.

· In such scams, victims typically befriended scammers online and developed relationships with them. In some cases, scammers would claim to have sent parcels containing luxurious items or large sums of money to the victims from overseas. Subsequently, the scammers’ accomplices would contact the victims, claiming to be a staff from a courier company or a government agency. The victims would be informed that the parcels had been detained for inspection by the authorities, and that they were required to transfer or remit money to local or foreign bank accounts, for fictitious reasons such as to resolve taxes, fines or anti-money laundering charges. The victims would also be threatened with the possibility of prosecution if they failed to send the money. In other instances, the scammers might claim that they needed financial assistance due to personal or medical reasons and would request for the victims to transfer money.

· Members of the public are advised to be careful when befriending strangers online. They should also be wary when they are asked to send money to people they do not know. If they are contacted by a stranger via phone demanding payment to a bank account in relation to Government fines or charges, they should remain calm and stop communicating with the person immediately.

Advisory on scams

The Police would like to emphasise the importance of not divulging personal information, especially banking information, to others. The majority of scams are perpetrated from overseas, and it is nearly impossible to recover monies once they are transferred out of Singapore. Everyone should only transact on platforms with consumer protection policies or insist on paying only after the goods have been received or services have been rendered.

The Police take a serious view of any person who may be involved in scams and frauds, and perpetrators will be dealt with firmly in accordance with the law. Members of the public may also be liable for criminal prosecution if their accounts are linked to illegal transactions. To avoid this, they should always reject requests by others to use their bank accountsIf or mobile lines.anyone suspects that their bank accounts may have been accessed without authorisation, they should inform the Police immediately.

For more information on scams, members of the public can visit www.scamalert.sg or call the Anti-Scam Hotline at 1800-722-6688. Anyone who suspects that they may have come across a scam may call the Police hotline at 1800-255-0000 or submit information online at www.police.gov.sg/iwitness.

PUBLIC AFFAIRS DEPARTMENT

SINGAPORE POLICE FORCE

4 MAY 2020 @ 2.55 PM

Annex A

TOP THREE SCAM TYPES OF CONCERN (JAN TO MAR 2020)

|

|

Cases Reported |

Amount Cheated |

|||

|

Jan to Mar 2020 |

Change from Jan to Mar 2019 |

Jan to Mar 2020(at least) |

Change from Jan to Mar 2019 |

Largest sum cheated(at least) |

|

|

E-Commerce Scams |

1,159 |

+623 |

$1.3m |

+$883k |

$175k |

|

Social Media Impersonation Scams |

466 |

+433 |

$1.0m |

+$838k |

$302k |

|

Loan Scams |

421 |

+140 |

$1.6m |

+$811k |

$92k |

Annex B

TOP FIVE DIGITAL PLATFORMS USED IN E-COMMERCE SCAMS (JAN TO MAR 2020)

Annex C

TOP FIVE ITEMS COMMONLY SCAMMED IN E-COMMERCE SCAMS (JAN TO MAR 2020)

Annex D

TYPES OF ELECTRONICS PRODUCTS INVOLVED IN E-COMMERCE SCAMS (JAN TO MAR 2020)

Annex E

EXAMPLES OF SPOOFED BANK MESSAGES

SINGAPORE POLICE FORCE

04 May 2020 @ 2:55 PM