The Singapore Police Force (SPF) would like to remind members of the public to remain vigilant against Government Officials Impersonation Scams where scammers impersonate staff from the telecommunications company, M1 Limited (‘M1’) and the Monetary Authority of Singapore (MAS). Since September 2025, there have been at least 13 cases reported with total losses amounting to at least $362,000.

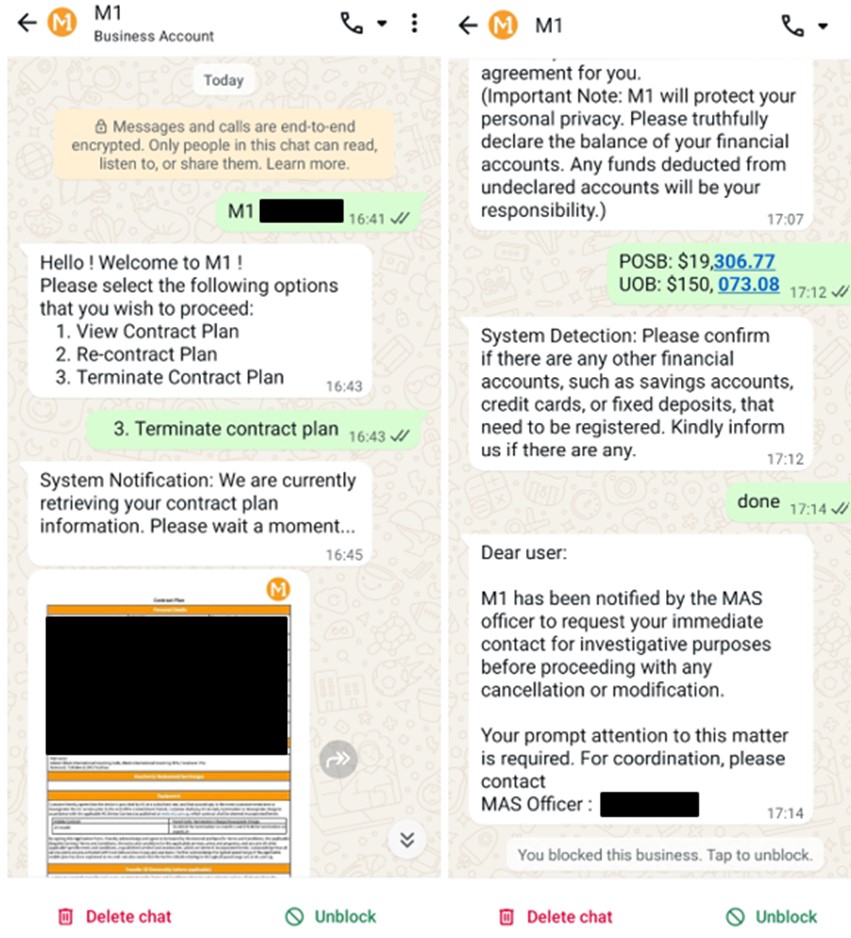

In this scam variant, victims would receive unsolicited calls, including WhatsApp calls, from scammers posing as staff from M1. The scammers would claim that victims had existing mobile plan subscriptions, and that they were calling regarding outstanding payments or mobile phone deliveries linked to those plans. When victims denied having such subscriptions, they were told to contact “customer service” via WhatsApp to terminate the subscription. The victims would be transferred to another scammer impersonating an officer from MAS, who would claim that the victims’ particulars were misused for criminal activities such as money laundering and fraud.

The scammers would then instruct the victims to perform monetary transactions for investigation purposes. These transactions include transferring monies via PayNow or to “safety accounts” designated by the government, handing over cash to unknown individuals, or performing cryptocurrency-related transfers. In some cases, the victims were instructed to screenshare via WhatsApp while logging into their bank accounts.

The victims would realise that they had been scammed when the scammers asked for more money to be deposited or when they sought verification with the SPF.

We would like to remind members of the public to NEVER transfer or hand monies/ valuables to unknown persons and persons whose identity you did not verify. NEVER place monies or valuables at a physical location to facilitate subsequent collection. Do not share the screens of your devices with any unknown persons. Singapore Government officials, including those from MAS, will never ask members of the public to do the following things over a phone call:

- Ask you to transfer money;

- Ask you to disclose banking log-in details;

- Ask you to install mobile apps from unofficial app stores; or

- Transfer your call to Police

Members of the public are encouraged to adopt the following precautionary measures:

- ADD – the ScamShield App to block calls and filter SMSes. Set transaction limits that are adequate for daily expenses, and lower transaction notification thresholds. Alert the bank immediately of any suspicious activity in your bank account. Activate the Money Lock feature of your bank to “lock up” a portion of your money so that it cannot be transferred out digitally by anyone.

- CHECK – for scam signs with official sources such as the ScamShield App. Call and check with the 24/7 ScamShield Helpline at 1799. Check the number displayed on the caller ID, as legitimate incoming calls from M1 will only display these caller IDs: 1622, 1627, 1623, or 1693.

- TELL – authorities, family, and friends if or when you encounter scams. If you suspect that you have fallen victim to a scam, call your bank immediately to block any fraudulent transactions and make a police report.

For more information on scams, members of the public can visit www.scamshield.gov.sg. Fighting scams is a community effort. Together, we can ACT Against Scams to safeguard our community!

Screenshots of WhatsApp chat with fake M1 customer service

PUBLIC AFFAIRS DEPARTMENT

SINGAPORE POLICE FORCE

06 October 2025 @ 10:00 PM