The Police would like to remind members of the public to remain vigilant against lucky draw and e-commerce scams involving social media live streaming platforms, such as Facebook Live. Since August 2025, there were at least 30 lucky draw scams and 13 e-commerce scams reported, with total losses amounting to at least $160,000.

In lucky draw scams, the victims would come across Facebook live streams promoting scratch cards, which offer the chance to win cash prizes. After the victims had purchased the scratch cards, the scammers would ask the victims to transfer more money to “upgrade” their chances of winning or increase the amount of the cash prizes. In some cases, the scammers enticed the victims to do so by allowing deferred payment. However, when the victims “won”, the scammers would ask the victims to transfer monies again for various reasons, such as for administrative fees, to receive their winnings.

In e-commerce scams, the victims would come across Facebook live streams selling bags allegedly containing gold (i.e., “gold mine bags”). The victims could purchase the bags for a chance to win. If the victims did not win, the scammers would ask the victims to purchase more bags, or to purchase “upgraded” bags which have a higher chance of containing gold. The scammers would also offer to re-purchase the gold from the victims at a price higher than the retail price. However, the victims would be asked to transfer more monies to receive their profits.

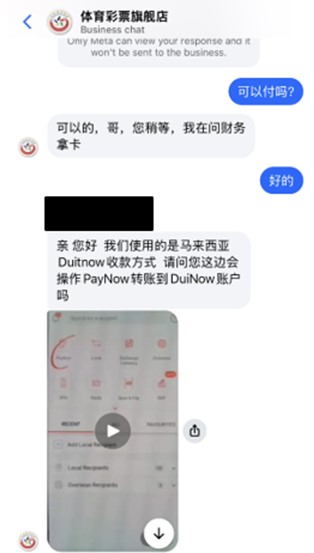

In most of these cases, the victims were instructed to make bank transfers, by PayNow or DuitNow transfers, often through QR codes provided by the scammers.

The victims would realise that they had been scammed when they did not receive their winnings or profits as promised, or when they sought verification with the Police.

We would like to remind members of the public to not transfer monies to any unknown persons and persons whose identity you did not verify.

Members of the public are also encouraged to adopt the following precautionary measures:

- ADD – Add the ScamShield App to block calls and filter SMSes. Set transaction limits that are adequate for daily expenses, and lower transaction notification thresholds. Alert the bank immediately of any suspicious activity in your bank account. Activate the Money Lock feature of your bank to “lock up” a portion of your money so that it cannot be transferred out digitally by anyone.

- CHECK – Check for scam signs with official sources such as the ScamShield App. Call and check with the 24/7 ScamShield Helpline at 1799.

- TELL – Tell the authorities, family, and friends if or when you encounter scams. If you suspect that you have fallen victim to a scam, call your bank immediately to block any fraudulent transactions and make a police report.

For more information on scams, members of the public can visit www.scamshield.gov.sg. Fighting scams is a community effort. Together, we can ACT Against Scams to safeguard our community!

Photos of Facebook Live

Photos of communications with the scammers

PUBLIC AFFAIRS DEPARTMENT

SINGAPORE POLICE FORCE

18 October 2025 @ 8:00 PM